A high deductible health plan is an insurance plan that has higher than normal deductibles. For example, a regular health plan may have a deductible of $50 to $500, but a high deductible health plan would have a deductible of $1,250 to $12,000. An insurance deductible is an out-of-pocket expense that a health plan policyholder has to pay before the insurance company would cover any costs for medical expenses.

The Benefits of a High Deductible Health Plan

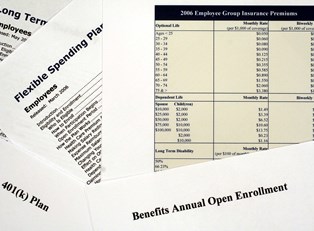

The main benefit of a high deductible health plan is the low monthly premium. A premium is a monthly fee that policyholders have to pay each month to maintain their coverage. A consumer might prefer to purchase a high deductible health plan to keep his or her monthly costs down to a minimum. A person who has generally good health could view the high deductible plan as beneficial because it’s fairly unlikely that they’re going to need much health care coverage. Another benefit of a high deductible health plan is that it makes you eligible for a health savings account. An HSA is a special savings account that gives taxpayers the ability to store funds for future medical use. The funds in such an account are tax-exempt, which gives the taxpayer a slight financial edge.

The Drawbacks of a High Deductible Health Plan

The negative aspects of the high deductible health plan include the high deductible. The policy holder will have to pay for all medical expenses until he or she reaches the yearly deductible. Therefore, an emergency may call for a great deal of cash. Emergency room visits can cost $2,000, and each regular doctor’s visit may cost several hundred dollars depending on the nature of the illness and the doctor’s prescribed treatment regimen.

How to Offset the Extra Expenses

A policy holder can offset the deductible expenses with the money that he or she has inside of a health savings account plan. A HSA account is a no fee bank account that you can use to set aside tax-free money to spend on medical bills. Since the HSA rules set a contribution limit of $3,250, you can set aside quite a chunk of money, tax-free for any HSA eligible expense.

A flexible spending account is an alternative option for people with high-deductible health plans. A flexible spending account, or FSA, is for workers who want to have a portion of their paychecks put aside into a special account for medical expenses. One of the FSA’s benefits is that the employees can use the funds for childcare expenses as well. Like a HSA plan, the money from the employee’s paycheck is exempt from federal taxes. Such accounts could be excellent ways to counteract the high deductible of an HDHP.